Why choose an Annuity for Lifetime Income?

Think of an annuity as a personal retirement strategy that can help your money grow and make it last longer when you retire. Your money grows faster because you don’t pay taxes on earnings until you actually withdraw them or until distributed to you. Then when you need it most, it can guarantee income for life.

What is an Annuity?

An annuity is a contract between you and an insurance company. You put money into the contract and in return, accumulate money which later it can provide a lifetime income stream. Money distributed from the annuity will be taxed as ordinary income in the year the money is received. Annuities are designed for long-term accumulation purposes. Guarantees, including interest rates and subsequent income payouts, are backed by the claims-paying ability of the issuing company. Prior to age 59 ½, early or excessive withdrawals may be subject to surrender charges or a penalty.

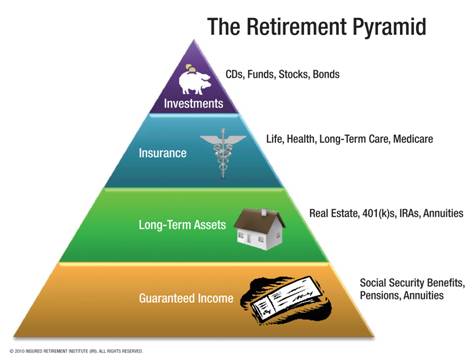

The below chart shows sources of retirement income for average current retirees

What are the advantages of an Annuity?

Tax-Deferred Growth

For deferred annuities, the power of tax deferral allows your money to grow faster because any earnings will compound without current income tax. Tax-deferred growth allows your money to grow faster because you earn interest on dollars that would otherwise be paid as taxes. Your principal earns interest, the interest compounds, and the money you would have paid in taxes earns interest. Whether you purchase your annuity with after-tax (non-qualified) or pretax (qualified) dollars, you have the benefit of tax-deferred compounding. With non-qualified plans, a portion of each income payment represents a return of premium that is not taxable, reducing your tax liabilities.

Lifetime Income Payout Option

Afraid of outliving your money? Usually called annuitization, this feature helps alleviate that fear by providing you with a guaranteed income stream for life. You have the ability to choose from several different income or annuitization options, including life or for a specific period.

Guaranteed Death Benefit

If you pass away before you begin to receive lifetime income or any other annuity payout option, your beneficiaries will typically receive at least the amount you originally invested plus any interest, minus any withdrawals. Death benefit payouts will be subject to ordinary income tax, unless the payments are used to fund a life insurance policy. See also “pension maximization”.

May Avoid Probate

Annuities offer the ability to name a beneficiary, which may minimize the expense, delays, and publicity that comes with probate. Your named beneficiary may receive death proceeds as either a lump sum or monthly income.

Optional Living Benefit Riders

Optional living benefits include principal protection, extra withdrawal provisions, and income benefits; sometimes for an additional charge. These optional features have greatly increased the flexibility and appeal of annuities as an option for retirement planning.

Flexible Withdrawal Options

What if you need to take money from your deferred annuity before you convert it to supplemental retirement income? An annuity provides a number of withdrawal options. However, it’s important to be aware that withdrawals and other distributions of taxable amounts may reduce the value of the death benefit and any optional benefits. In addition, withdrawals and other distributions may be subject to income taxes and, if taken prior to age 59½, a 10% federal tax penalty may apply. Withdrawal charges and a market value adjustment may also apply.

Policy Types

We offer a variety of Annuity options depending on your needs.

Fixed Deferred Annuities

With fixed annuities, premiums accumulate at a declared fixed interest rate that is guaranteed for a specific period and guaranteed to never go below a specific percentage. Rates of interest are set by the company for the life of the contract. Generally, after the initial guaranteed period expires, a renewal rate will be declared by the insurance company. Declared renewal rates will always be set at the contract’s guaranteed minimum interest rate or higher.

Indexed Annuities (IA)

An Indexed Annuity is usually a fixed (i.e., not a variable) annuity with alternate methods of determining and crediting interest. Once the interest is credited you are guaranteed that it can never go down based on future market fluctuations. While traditional fixed annuities typically declare interest in advance, an IA’s performance is usually linked to specific market indices (frequently the S&P 500 Index® or other major indices) over a stated period that you can choose on an annual basis. For example, the interest credit for an IA might be defined as 70% of the rate of increase in the S&P 500 Index® over each one-year period, but none of its downside. Different IA’s present different methods of determining the interest credits and many offer up-front bonuses as well to help accelerate growth.

Unlike traditional fixed annuities, the policy owner may receive zero interest for a single period on a specific premium payment if the index performs poorly. However, with most IA designs, the premiums are protected and guaranteed to grow over time. This is a feature unavailable with any form of direct participation in the marketplace, such as through a mutual fund or a variable annuity. Moreover, in better market conditions, the owner of an IA may experience interest credits that outperform traditional fixed annuities or CD’s.

Immediate Annuity or Annuitization

You are guaranteed an income stream ranging from a specific period of time to your entire life. An immediate annuity offers a solution to the problem of outliving your money. It can be purchased with a single lump-sum contribution (or come from an annuitized policy) and can help to maximize and protect income for the rest of your life. In return for your contribution, the insurance company provides you a pension-like stream of guaranteed, consistent income for your lifetime or for a specified period of time. You can be confident that your income amount will never vary because of market performance. You can customize your income to meet your retirement planning needs by choosing from a variety of payment options. Income payments will differ based on several factors, including your age, gender, and the account balance. Once the contract is issued, the income option and frequency selected cannot change. While some immediate annuities do offer you some access to your money, it should be noted that immediate annuities are less liquid than deferred annuities.